Is Gold and Investment?

Precious Metals Investing 101

Quick Answer: Gold is not an investment. It is a storage of value

- Precious metal are all about certainty

- In the medium to long term, precious metals always provide more certainty than currencies

This article is about physical gold. This means the possession of gold items, in bullion form, with the ability to dispose of it as pleased.

What is an Investment?

An investment is something that purposefully chosen that changes value (hopefully for the better) and provides return (hopefully positive return rather than negative)

There are good investments, bad investments and non-investments.

A Matter of Input and Output:

In life, ideally, you should always get more out of something than what you put in. The output should be greater than the input. At least that is the expectation. The reward should be higher than the expenditure. This applies not just in finances, but in other aspects of life. For example, in a relationship, a little bit of effort should result in a lot of fun. So it boils down to input and output.

- Good Investment: Output is greater than input

- Bad Investment: Output is lesser than input

- No-Investment: Output is almost equal to input

Gold as Investment Vs Gold as Storage of Value:

Although it has some investment features, in reality, gold and precious metal are in reality not intrinsically investments. Precious metal possession is a storage of value.

Gold works as an investment only when compared to currencies. In our case, in comparison with the US Dollar.

- We say that gold is a good investment when the gold we bought at a certain moment later fetches more dollars that when we bought it

- We say that gold is a bad investment when the gold we bought at a certain moment later fetches less dollars than when we bought it

This reasoning however, only works when gold is compared to currencies. So if we compare the how much gold can get for our dollars, or vise-versa, then gold would be qualify as an investment. However, in reality, upon further analysis, this is type of reasoning is misguided.

Gold as Storage of Value

Physical gold is rare metal, meaning that is hard to find. Not only that, it has unique characteristics and hundreds of applications, many for which it has no substitute. There is always demand for gold. Few people have gold. Lots of people want and need gold. This is nothing new. Gold has been valuable for thousand of years.

Today, as you read this, gold is just as valuable and in as much demand as 4,000 years ago. Archeologists have calculated that when the Egyptian Pharaos got started, the gold mines of Egypt where at least already 200 years old. So value gold is basically perpetual. In the case of the US Dollar, the US Dollar, as we know it today, dates back to only 1971 (when decoupled from Gold by Nixon). So what is more certain? Gold or the US Dollar.

Examples of Gold as Storage of Value

It is said that a nice modern businessman suit exchanges for as much gold as Roman or Victorian businessman suit. I was able to confirm this my self.

- A couple of years ago, a customer sold me a Krugerrand. He told me that almost 10 years prior, he sold another Krugerrand to buy a storage shed for his backyard. As of when he sold me the gold coin, he could use what I paid him for buying almost exactly the same storage shed. However, if instead of keeping the coin, he would have kept its equivalent in US Dollars, now he could not have bought another almost exact shed with that money.

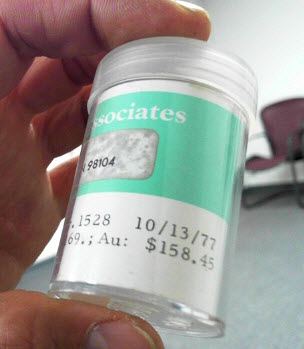

- Not long ago I bough (20) Krugerrands. The gentleman that sold them bought them when gold was at $158.45 per ounce troy. On the surface it seems that in 1977 gold was really cheap. But no. At that time, you could do a lot more with $158.45 than today! See image below.

Based on the above examples, it could be said that gold was an investment. However, as demonstrated, in reality, gold was a storage of value. It is not that the gold went up. It is that the US Dollar devalued. Basically, after time passed, it more dollars were required to buy the same item.

Summary:

- Gold is not an investment

- Gold has some investment qualities

- Gold is a storage of value

- Gold is all about certainty

(20) Krugerrands in 1977 at $169 each. How much are they today?

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/platinum/t24_pt_en_usoz_2.gif)